prince william county real estate tax assessment

Enter Your Zip Start Searching. All real property in Prince William County except public service properties operating railroads.

Class Specifications Sorted By Classtitle Ascending Prince William County

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

. 4379 Ridgewood Center Drive Suite 203. If you own real property in Prince William County you need to know how property tax assessments work. Submit Business Tangible Property Return.

Prince william county real estate tax due dates 2021 Monday May 30 2022 Edit. Enter the house or property number. Prince William County Virginia Home.

Submit Business License Return. Hi the county assesses a land value and an improvements value to get a total value. Ad Find Current Assessed Values.

Report High Mileage for a Vehicle. We Provide Homeowner Data Including Property Tax Liens Deeds More. 703 792 6780 Phone The Prince William County Tax.

Prince William County Real Estate Assessor. Use both House Number and House Number High fields. Submit Business Tangible Property Return.

Submit Consumer Utility Return. Report High Mileage for a Vehicle. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

By creating an account you will have access to balance and account information notifications etc. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Find Current Assessed Values. While the Office of Real Estate Assessor has attempted. At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the.

Submit Business Tangible Property Return. The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year. Ad Uncover Available Property Tax Data By Searching Any Address.

Instant Accurate Results. Ad Current Assessed Value of Real Estate. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

Then they get the assessed value by multiplying the. These records can include prince william county property tax assessments. Instant Accurate Results.

Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. Comments may be made by telephone at 804 722-8629 or via e-mail to assessorprincegeorgecountyvagov. The Ultimate Guide to the Prince William County Property Tax Assessments.

Prince William Virginia 22192. If you have questions about this site please email the Real Estate. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

The county proposes a new 4 meals tax to be charged at restaurants. If you are searching. Find Accurate Home Values Instanty.

Prince william county real estate tax lookup. How property tax calculated in pwc. You can call the Prince William County Tax Assessors Office for assistance at 703-792-6780.

Prince William County collects on average 09 of a propertys. Report a Vehicle SoldMovedDisposed. Start Now for Free.

If you have questions about this site please email the Real Estate. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Learn all about Prince William County real estate tax.

They are maintained by.

Prince William County Sheriff S Office Wikiwand

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Park Rangers New On Call Number Effective April 1 2022

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

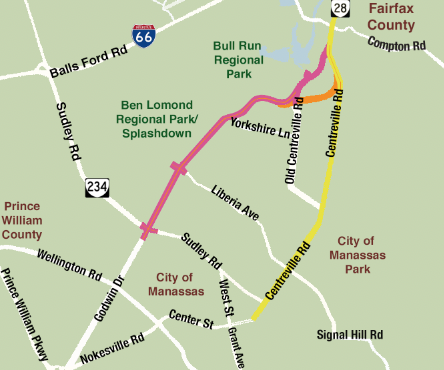

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William County Launches A New Show Called County Conversation

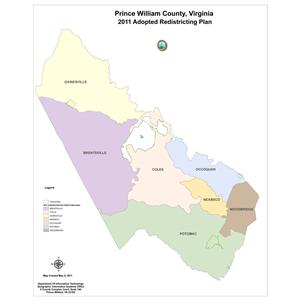

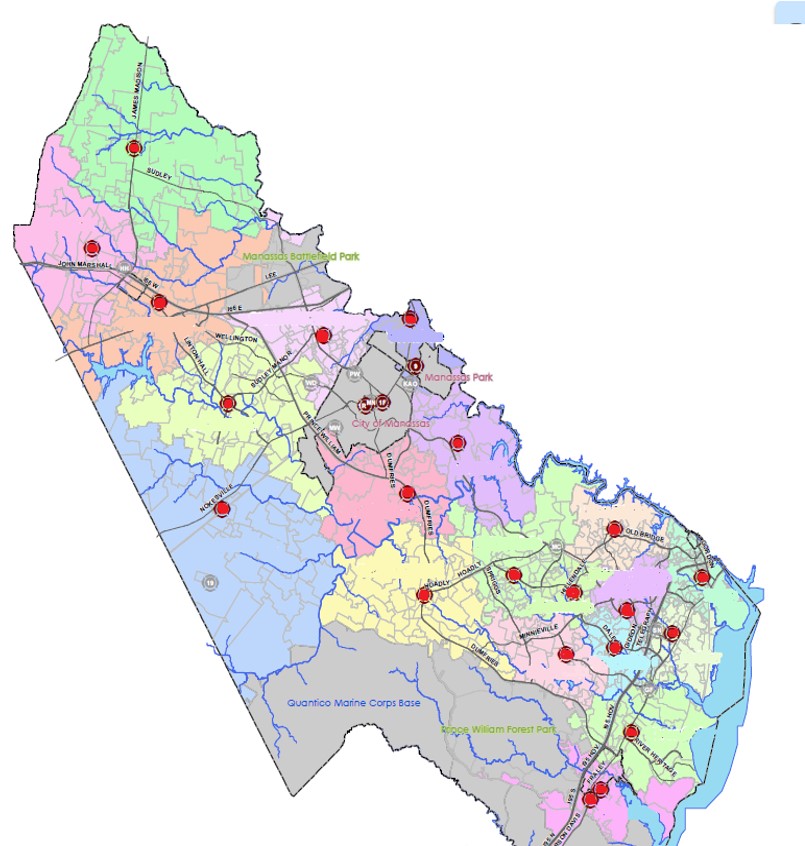

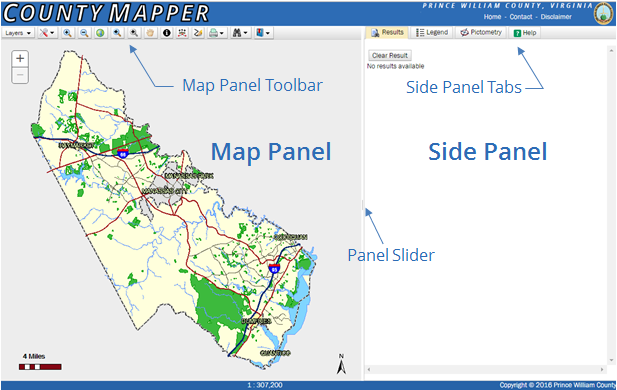

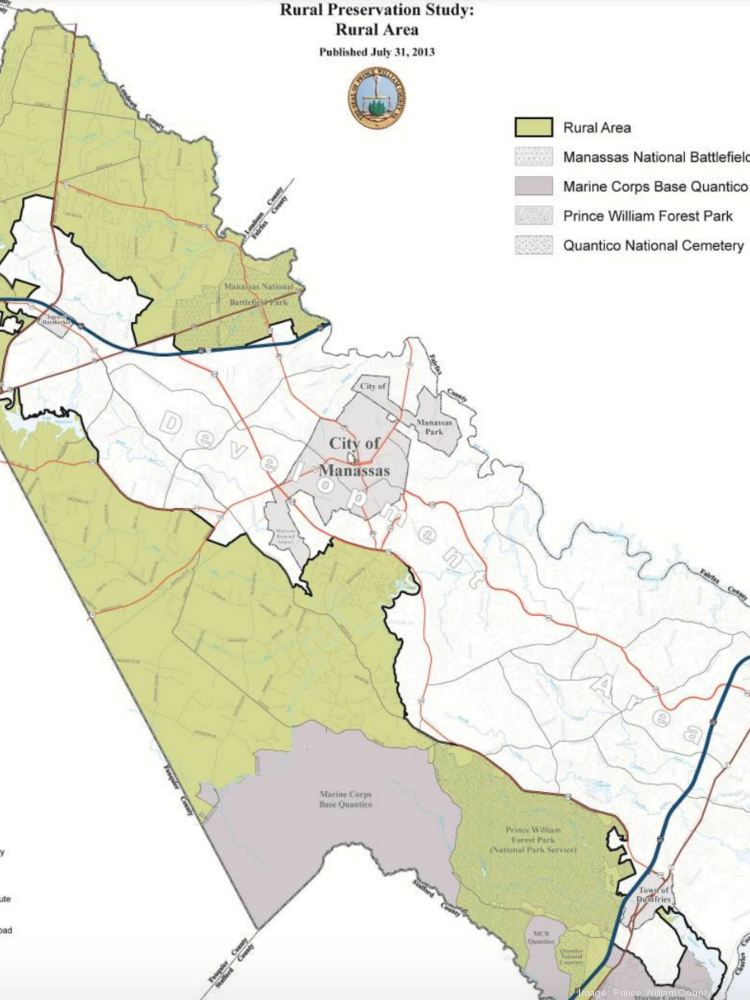

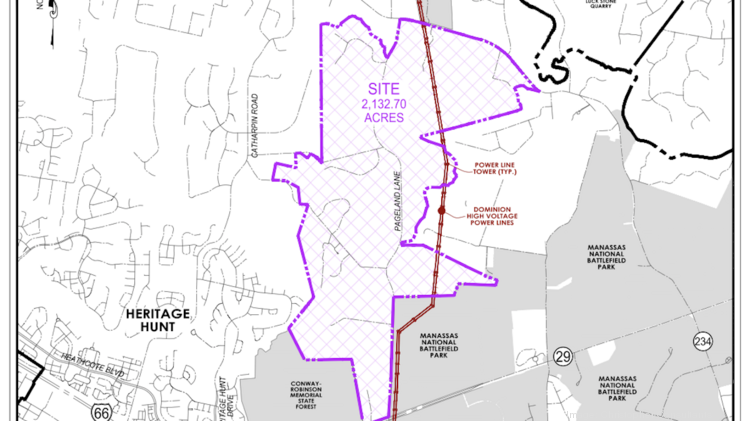

Data Center Opportunity Zone Overlay District Comprehensive Review

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal